Invest and Own a Piece of a Successful Online Business

Miles Group provides US based accredited investors with unique opportunities to invest in thriving, healthy and growing online businesses.

Are you a business owner looking to sell your business?

Apply here.

Predicted returns based on Miles Group’s Index.

Share in the growth of the platform economy.

Connect with the business owner and invest in something you believe in

Why Miles Group?

With Miles Group, we open up access to a private network of growing businesses. These opportunities are exclusive to Miles Group and available to accredited and non-accredited investors*.

We’re talking, established, fast growing and revenue generating eCommerce and SaaS businesses, and real estate deals. Each of these businesses has a planned exit strategy and the offer is limited to a small number of investors. Investors take an equity position in the online business, facilitated by a Special Purpose Vehicle (SPV).

Who Can Invest?

Miles Group opportunities are only available to Accredited investors who are residents of the United States. Prior to investment all investors will be required to complete an accredited investor check on the Assure platform.

How Does it Work?

Miles Group vet deals and perform due diligence on each deal.

Interested investors can review opportunities and connect directly with Miles Group to discuss opportunities.

Investors who make a commitment to invest will then be asked to go through an accredited investor check including completing a profile and accredited investor check – Rule 506(c)

Once the minimum target raise amount is reached, Assure (Manager) in partnership with Miles Group, will setup a Special Purpose Vehicle Agreement (SPV), and execute a Security or Unit Purchase Agreement to purchase the agreed units from the target company.

The raised funds (minus any applicable fees) are then transferred to the target company.

Miles Group will maintains a connected ‘page’ showcasing insights and updates providing near real-time updates back to investor.

Assure completes the required annual K-1 tax forms for the relevant businesses.

You own a piece of a online business!

Who is this investment for?

Who this is for:

Accredited and Non-accredited investors*

who want exposure to online businesses but may not have the time or skill set

Entrepreneurs and Founders

who may have the skill but want passive returns and diversification

Who this isn't for:

Non-accredited investors or those who don’t have the capacity to take on the risk or diversify across multiple deals.

Active investors

looking to run their own online business

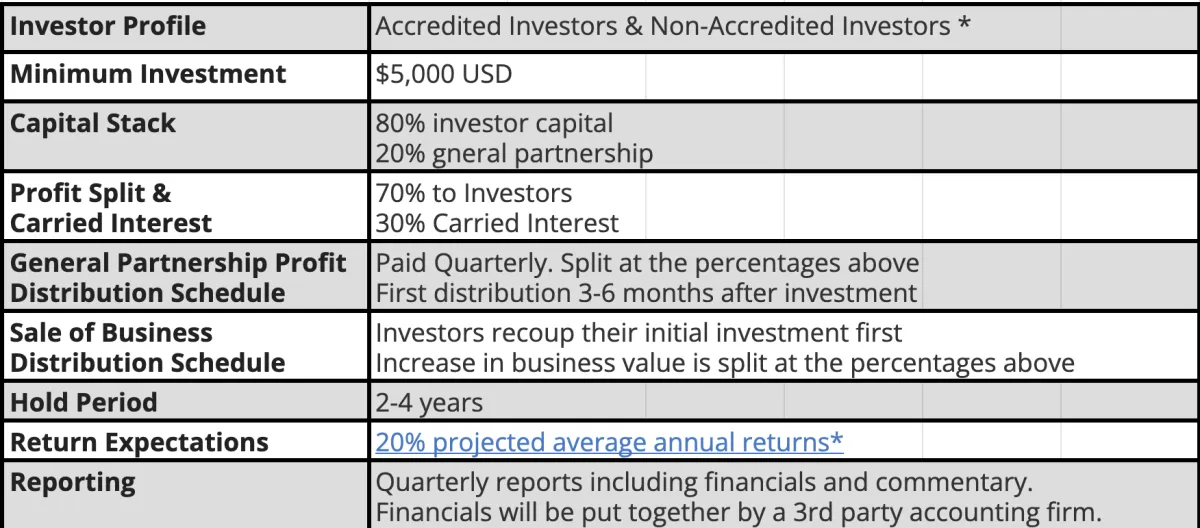

Miles Group Summary of Terms

* These are estimated returns which may be significantly higher or lower. There is no cap or guarantee on returns, and investments may result in partial or total loss. Please refer to legal fund documents for full detail of terms.

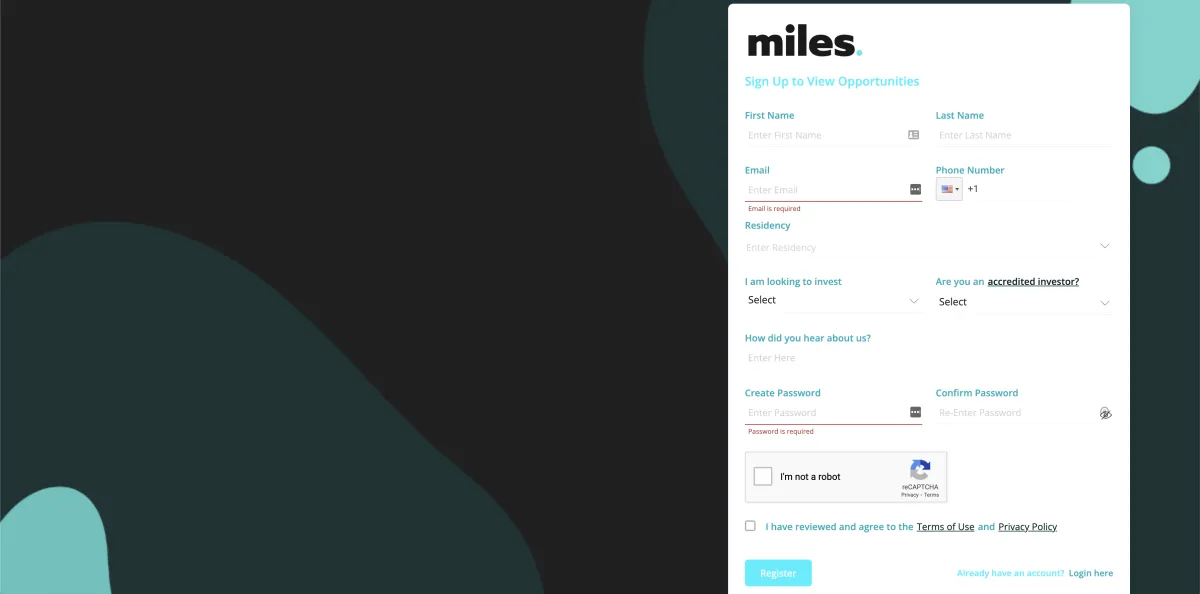

Getting Started Is Easy

STEP 1

Register for your account.

To access our deal, signup to join our investor network.

STEP 2

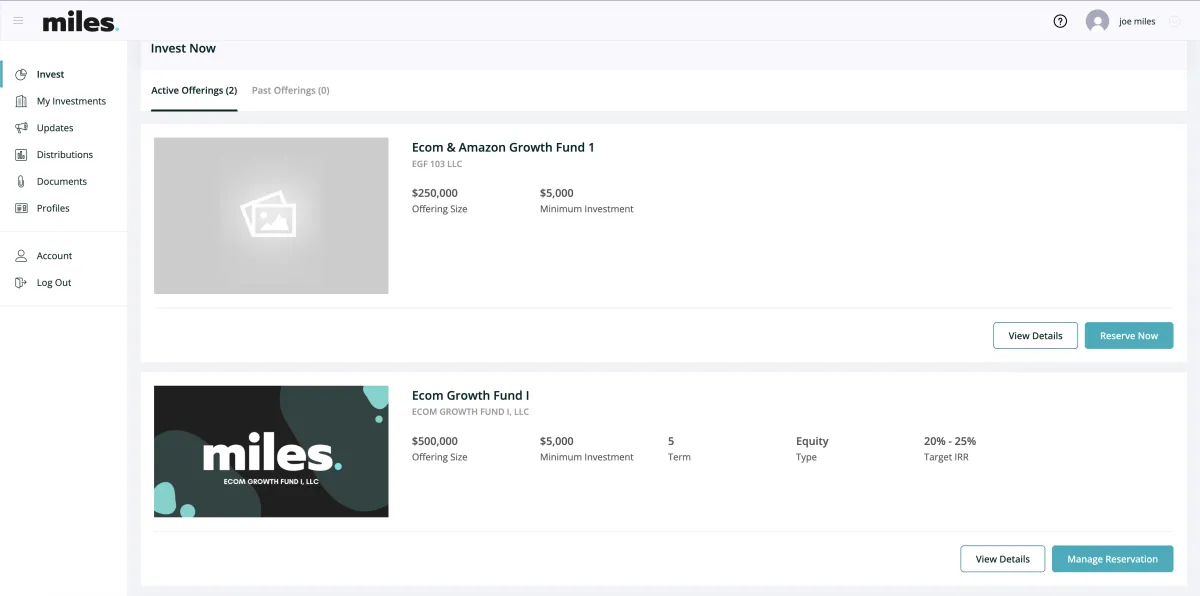

Browse Investment Opportunities

Explore a diverse range of investment opportunities and click through to view the pitch, comprehensive information and financial insights.

STEP 2

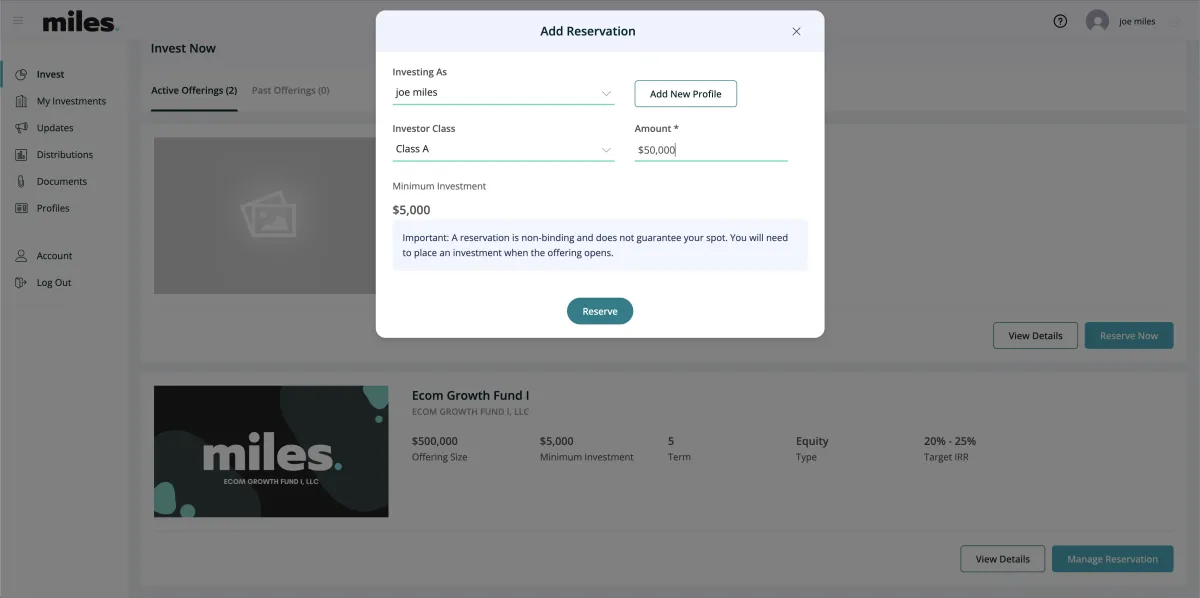

Invest into your desired deal.

On our platform you are able to invest in you desired deal.

STEP 4

Receive passive income

So you invested an! now it's time to sit back and let us make you passive income. .

Investor FAQs

What are the minimum investment requirements?

Minimum investment is $5K per deal. We strongly recommend doing multiple deals to get the proper diversification.

What are the risks I should be aware of?

Past performance is no guarantee of future results and any expected returns on investment disclosed through the investor platform are hypothetical and may not reflect actual future performance. All investments made through the investor platform may result in partial or total loss. All fund performance information disclosed through the Investor Platform is presented prior to the removal of all management fees and expenses unless otherwise disclosed. Some of the statements made on the Investor Platform constitute forward-looking statements and should not be relied upon as predictors of future events. These statements may fail to account for both known and unknown risks, market or other uncertainty, changes in the economy as a whole, or changes outside of the control of the Portfolio Manager. Nothing contained within the Investor Platform or the Services should be considered investment advice and you should obtain investment and tax advice from independent investment professionals prior to investing in any offering provided through the Investor Platform or the Services. All information provided through the Investor Platform and the Services, including information in private placement memorandums, have been prepared without knowledge of or concern for each Investor’s individual financial situation or risk tolerance. Nothing contained within the Investor Platform or the Services should be considered to constitute tax, legal, or investment advice.

What are the accreditation requirements?

The official SEC criteria for accredited investors is outlined below. Income can be from any source including your own business. The only exception is income from your primary residence.I. Subscriber has a net worth, either individually or upon a joint basis with Subscriber ’s spouse, of at least $1,000,000, or has had an individual income in excess of $200,000 for each of the two most recent years, or a joint income with Subscriber ’s spouse , or spousal equivalent, in excess of $300,000 in each of those years, and has a reasonable expectation of reaching the same income level in the current year.II. Subscriber is an irrevocable trust with total assets in excess of $5,000,000 whose purchase is directed by a person with such knowledge and experience in financial and business matters that such person is capable of evaluating the merits and risks of the prospective investment.III. Subscriber is a bank, insurance company , investment company registered under the Company Act, a broker or dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934 (the “Exchange Act “), a state -registered or SEC -registered investment adviser, an exempt reporting adviser pursuant to Section203(l) or 203(m) of the United States Investment Advisers Act of 1940, as amended (the “Advisers Act”), a rural business investment company (RBIC ) as defined in Section 384 A of the Consolidated Farm and Rural Development Act, a business development company , a Small Business Investment Company licensed by the United States Small Business Administration , a plan with total assets in excess of $5,000 ,000 established and maintained by a state for the benefit of its employees , or a private business development company as defined in Section 202(a)(22) of the Advisers Act.IV. Subscriber is an employee benefit plan and either all investment decisions are made by a bank, savings and loan association, insurance company, or registered investment advisor, or Subscriber has total assets in excess of $5,000,000 or, if such plan is a self-directed plan, investment decisions are made solely by persons who are accredited investors.V. Subscriber is a corporation, partnership, limited liability company or business trust, not formed for the purpose of acquiring the Interests, or an organization described in Section 501(c)(3) of the Code, in each case with total assets in excess of $5,000,000.VI. Subscriber is an entity in which all of the equity owners, or a grantor or revocable trust in which all of the grantors and trustees, qualify under clause (i), (ii), (iii), (iv) (v) above or this clause (vi) . If Subscriber belongs to this investor category only, list on a separate sheet to be attached hereto the equity owners (or grantors and trustees) of Subscriber and the investor category which each such equity owner (or grantor and trustee) satisfies.VII. If a Subscriber holds, in good standing, one of the following certifications or designations administered by the Financial Industry Regulatory Authority, Inc. (“FINRA”): the Licensed General Securities Representative (Series 7), Licensed Investment Adviser Representative (Series 65), or Licensed Private Securities Offerings Representative (Series 82).VIII. If a Subscriber is a “knowledgeable employee” within the meaning prescribed under Rule 3c-5(a)(4) of the Investment Company Act of 1940, as amended (the “ Investment Company Act”) of a private fund exempt from registration pursuant to Rule 3(c)(1) or Rule 3(c)(7) of the Investment Company Act.IX. Subscriber is an Indian tribe, governmental body, or an entity organized under the law of a foreign county, that owns investments, as defined in Rule 2a51-1(b) of the Investment Company Act, in excess of $5,000,000.00, and was not formed for the specific purpose of investing in the securities offered.X. Subscriber is a family office, as defined in Rule 202(a)(11)(G)-1 of the Advisers Act (the “Family Office Rule”, or a “family client” of such family office as such term is defined in the Family Office Rule: (a) with assets under management in excess of $5,000,000.00, (b) not formed for the purpose of acquiring the Interests, and (c) the acquisition of the Interests is directed by a person who has such knowledge and experience in financial and business matters that he or she is capable of evaluating the merits and risks of acquiring the Interests.

Will non-American citizens be able to invest?

Absolutely. As long as investors meet the accreditation requirements as laid out by the SEC they will be able to invest.

Will there be any future capital calls?

There will be no additional capital calls for investors, meaning you’ll never be required to contribute additional funds into any deal.

What reporting will be available, timing of reports and verification?

Investors will receive a quarterly report on their deals with financials and written commentary. Financials will be put together by a 3rd party accounting firm, who will have direct access to the monetizations and bank accounts. They will pull the numbers and put the reports together. EF Capital will audit the reports for any questions or anything unusual and ask the portfolio managers to explain in detail. Portfolio Managers will put together commentary on the performance of each deal, what happened in the last quarter and their plan for the coming quarter.

How do acquisitions work? (Businesses)

Once you’ve made your initial investment, the portfolio manager will continue to raise funds from other investors to acquire the full amount needed. We will hold all the investment funds in a segregated account and ensure they are only deployed to purchase businesses that match the portfolio manager’s predetermined criteria. Note: If the money is not deployed within 90 days from the acquisition of full funding, it will be refunded to the investors. If the portfolio manager acquires less than the amount raised including money set aside for growth, the difference will be refunded to investors proportionally. The portfolio manager will acquire a business from Empire Flippers that matches their acquisition criteria and growth plan. Once the funds are deployed and the business has been acquired, the portfolio manager may reinvest some of the monthly profits into growth. Some portfolio managers will set aside some of the money that has been raised to be used for growth, and if they do, the amount will vary from portfolio manager to portfolio manager and will be outlined on the individual deal page.

How do acquisitions work? (Real Estate)

Once you’ve made your initial investment, the portfolio manager will continue to raise funds from other investors to acquire the full amount needed. We will hold all the investment funds in a segregated account and ensure they are only deployed to purchase businesses that match the portfolio manager’s predetermined criteria. Note: If the money is not deployed within 90 days from the acquisition of full funding, it will be refunded to the investors. If the portfolio manager acquires less than the amount raised including money set aside for growth, the difference will be refunded to investors proportionally. The portfolio manager will acquire a business from Empire Flippers that matches their acquisition criteria and growth plan. Once the funds are deployed and the business has been acquired, the portfolio manager may reinvest some of the monthly profits into growth. Some portfolio managers will set aside some of the money that has been raised to be used for growth, and if they do, the amount will vary from portfolio manager to portfolio manager and will be outlined on the individual deal page.

What is the legal and ownership structure?

Each deal is a separate legal entity with separate investors and separate portfolio managers. It is set up this way to limit liability for the investors and limit risk to any given deal. Portfolio Managers and investors own the LLC equivalent to the cash they put in (95% Investors, 5% Portfolio Manager). Portfolio Manager, EF and Advisors receive an additional carried interest based on the profits but no additional ownership.

How can this be treated for tax purposes?

Each LLC is a passthrough entity. You will get a K-1 that shows the income of the LLC. Any income and any eligible depreciation will pass through. Please consult with your tax accountant for planning advice.

Is there tax withholding for non-Americans?

Yes, the setup is standard. If you’re a non-American and have invested internationally it will be exactly the same. Tax withholding on non-American companies is 21%. Tax withholding on foreign individuals is 37%. Please note that foreign trusts are taxed at the individual rate of 37% as well. The US has tax treaties with many other countries so you should not be double taxed even if they withhold a higher amount you may be able to file a tax return and claim some of it back. Please consult with your tax accountant for planning advice.

Can investors be involved in the operations of the business?

Apart from investing your capital and choosing which portfolio manager you want to work with, this investment will be completely passive. You will not have access to the portfolio manager to ask questions or give your input on how to run the business. You will simply receive a quarterly report and a quarterly payment for each deal you invest in.

Am I required to have an ITIN (Individual Taxpayer Identification Number) to invest?

You don’t need to have an ITIN in order to invest. Instead you can enter a “Foreign Tax Identification Number”. The name of this number will vary from country to country but It’s a number that’s used by your local government (usually related to taxes).

Can I invest with my company?

Yes, you can invest with your company as long as all company owners meet the accreditation requirements.

Can foreigners invest?

Yes, the process is almost identical. You need to meet the SEC’s definition of an accredited investor.

What happens if a business goes to zero?

With digital assets, the risk and reward profile is high. That’s why you should look to diversify across multiple monetization types, strategies, and operators. If one of these businesses fails, the operator will make all efforts to recover the asset to get it back on track using funds currently available as there are no additional capital calls. After all efforts, the operator will determine whether it is recoverable or if the asset needs to be divested completely.Keep in mind that the model assumes a percentage of businesses will fail. The yield from digital assets allows for some level of failure across your portfolio while still achieving strong returns.

What happens if the deals are not fully funded?

In the case deals are not fully funded, we will first check with the operator to see if they can still operate their strategy with the amount raised. If so, we will give investors the option to stay invested or have their money sent back.

What can I expect in each legal document?

A subscription agreement is an agreement that defines the terms for a party’s investment into a private placement offering or a limited partnership (LP). Rules for subscription agreements are generally defined in SEC Rule 506(b) and 506(c) of Regulation D.The Private Placement Memorandum (PPM)- is the document that discloses everything the investor needs to know to make an informed investment decision prior to investing in a Regulation D Offering. Unlike a Business Plan the PPM details the investment opportunity, disclaims legal liabilities and explains the risk of losses.An operating agreement is a key document used by LLCs because it outlines the business’ financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Disclaimer

This website (this “Site”) is owned and maintained by Miles Technologies. Neither Miles Technologies. nor Miles LLC and related companies. (“Miles Group”) are registered broker-dealers, and neither provides investment advice, endorsement, analysis or recommendations with respect to any securities. All securities of companies listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. Miles Group does not make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings posted on this Site.Neither Miles Group nor any entity managed or advised by Miles Group, or any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors. Miles Group has reviewed but makes no assurance as to the completeness or accuracy of any such information. Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results

or returns.The investments (regardless of the nature of such investment) offered on the Miles Group platform or on any other platform directly related to or affiliated with Miles Group have not and will not be registered under the U.S. Securities Act of 1933 (or with any state, or non-U.S. securities authority) and are offered pursuant

to exemptions therefrom.Neither Shopify nor Semrush are affiliated with Miles Group accessing the Site and any pages thereof, you agree to be bound by Miles Group’s Terms of Use and Privacy Policy.

Terms of Use and Privacy Policy